Calculate Value at Risk in R

I have done the following- x- matrix 140 ncol 4 xapp - applyx 2 quantile probs c010205 It gives me the following output-. 5 Estimate the value at risk VaR for the portfolio by subtracting the initial investment from the calculation in step 4.

Varioety Of Demo Notebooks Done With R Python And F Jamesigoe Azurenotebooks Master Github Financial

Finally we can calculate the VaR at our confidence interval var_1d1.

. I am trying to find the value at risk. α r to construct a joint probability distribution for 1 RThey then exploit the functional. Financial Risk Management with R.

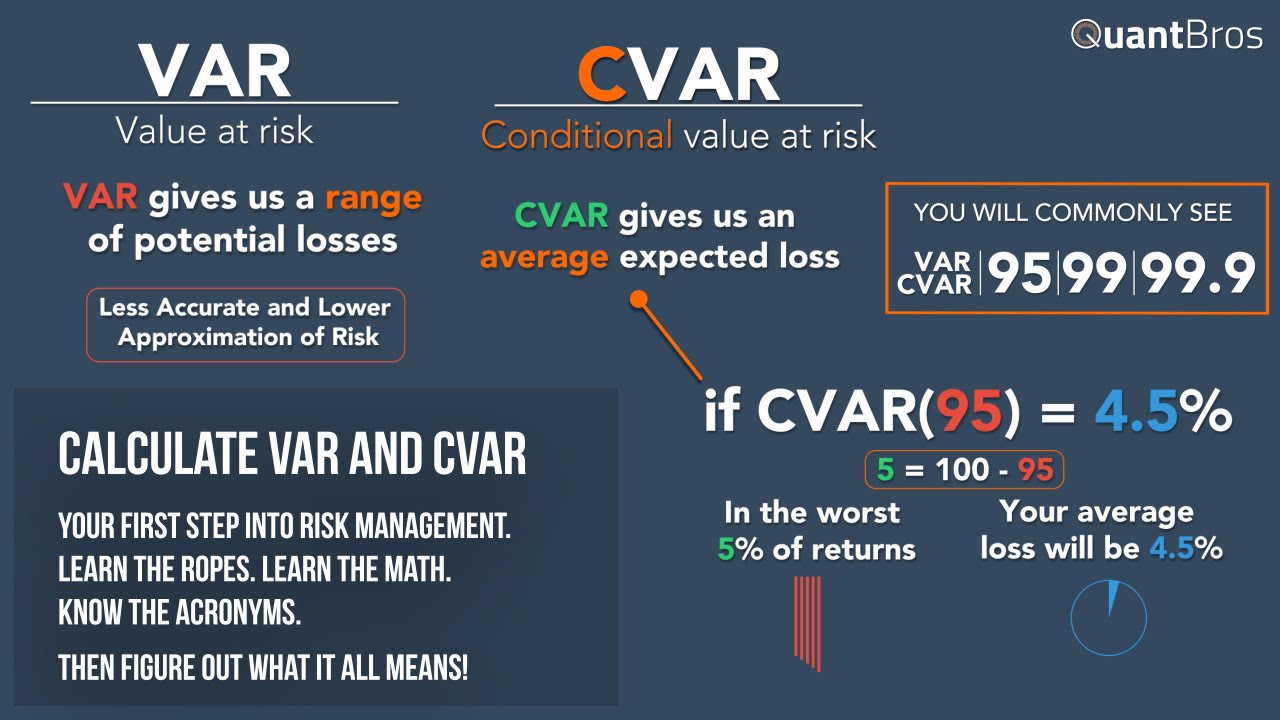

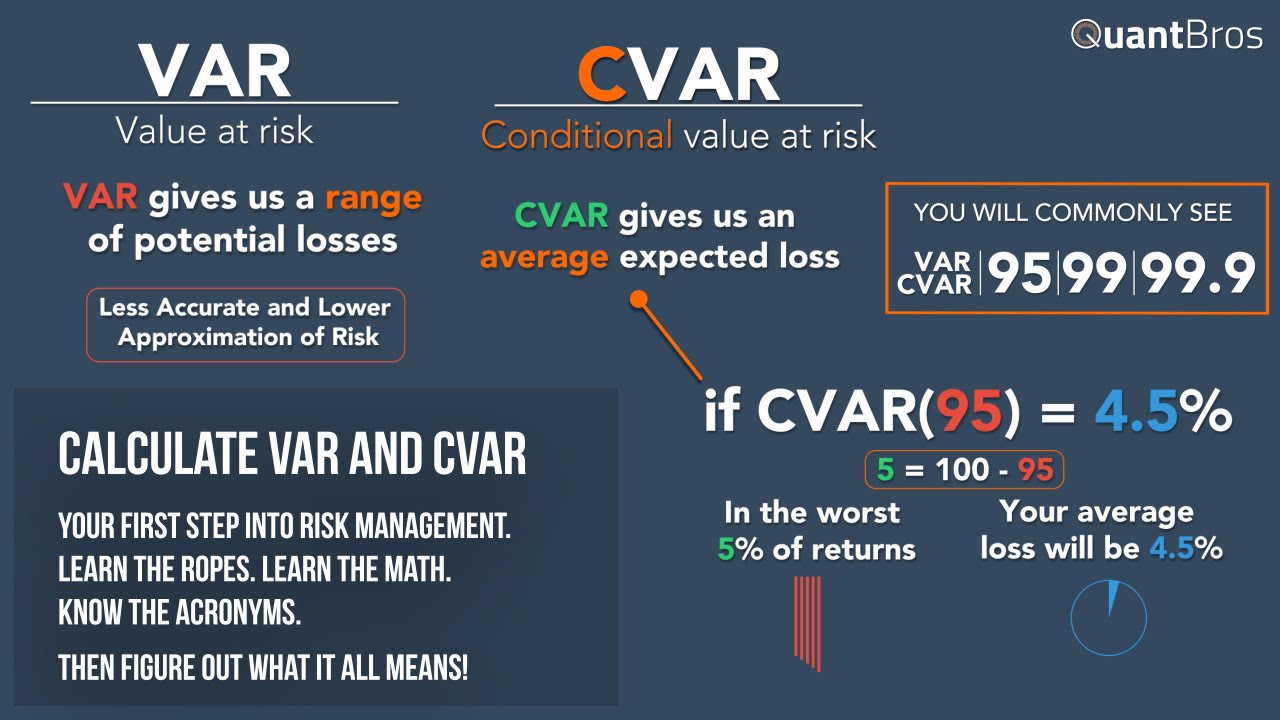

Up to 25 cash back The standard function qnorm calculates quantiles of a normal distribution from the probability p the mean and standard deviation and thus can be used to. VAR is determined by three. Value at Risk VaR is the most widely used market risk measure in financial risk management and it is also used by practitioners such as portfolio managers to account for.

Take care to capitalize VaR in the. Conditional Value at Risk CVaR This is also known as the expected shortfall average value at risk tail VaR mean excess loss or mean shortfall. Where W0 is the value of the portfolio at time of calculation N is the holding period sigma is the daily volatility and Z is the inverse of the normal.

Value at Risk vm vi vi - 1 M is the number of days from which historical data is taken and v i is the number of variables on day i. This course teaches you how to calculate the return of a portfolio of securities as well as quantify the market risk of that portfolio an important skill for. The purpose of the formula is to calculate.

Value-at-risk measures apply time series analysis to historical data 0 r 1 r 2 r. Here is the formula. Value at Risk VAR is a statistic that is used in risk management to predict the greatest possible losses over a specific time frame.

This function provides several estimation methods for the Value at Risk typically written as VaR of a return series and the Component VaR of a portfolio. CVaR is an extension of.

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Finance Money Quotes

Forex Signals Stock Trading Strategies Trading Quotes Options Trading Strategies

Profxtrades Risk Management Guide Follow Profxtrades For More Daily Tips And Analysis Forex Trading Training Trading Charts Stock Trading Strategies

Calculating Var And Cvar In Excel In Under 9 Minutes Calculator Excel Risk Management

No comments for "Calculate Value at Risk in R"

Post a Comment